55+ tax implications of paying off someone else's mortgage

File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way. Heres an example of how families can amass a bigger gift.

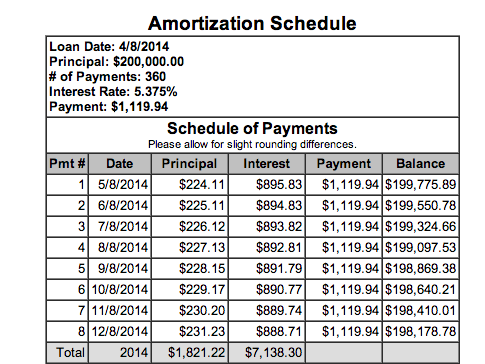

Think Twice Before Paying Off Your Mortgage Early Knowledge At Wharton

For example Lenas first-year interest expense.

. Web Any one person can give a gift of 15000 or less to another individual and not have to pay taxes on it. This makes your taxes go up. Web Can you pay on someone elses mortgage anonymously.

IRS Form 1098 If youre the owner of a mortgaged property. Web If you leave your job at age 55 or older and want to access your 401k funds the Rule of 55 allows you to do so without penalty. Mortgage interest is tax deductible.

The over-55 home sale exemption is an obsolete tax law that provided homeowners over the age of 55 with a one-time capital. Web If youre renting your property out you get to keep the mortgage interest and property tax deductions for instance. Web If your mother pays off your mortgage for you or any other debts that you have this would be considered a gift.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web Aside from a gift there are a few other ways you may be able to pay off another persons mortgage or help them get caught up on a mortgage that may be close.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. If you gift it then it is just like a cash giftno longer yours and.

Web Over-55 Home Sale Exemption. Whether youve been laid off fired or simply quit. Web Your credit score is unlikely to change much after paying off your mortgage.

If and when gift tax is ever due it is paid by the. I just got a new job and while I know I need to be paying on my mortgage I want to pay on somebody elses mortgage. Web You dont owe gift tax unless your total lifetime gifts are more than 54 million and the recipient does not owe tax except for certain foreign transactions.

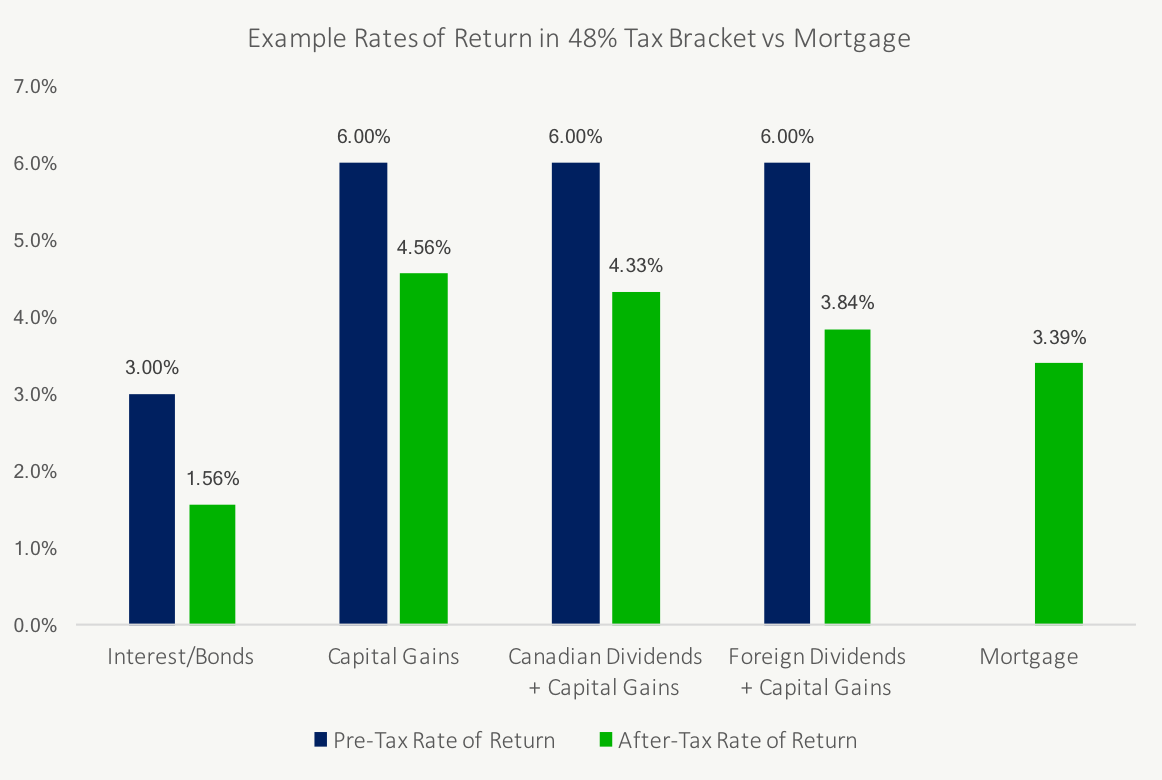

For example if you. Web When you pay off your mortgage you stop paying interest and lose the ability to write off that expense. Web The rule of 55 is an IRS guideline that allows you to avoid paying the 10 early withdrawal penalty on 401 k and 403 b retirement accounts if you leave your job.

Web However another cost of paying off a mortgage early is higher taxes. Web If someone were to pay off someone elses mortgage gradually ie. Web He also pointed out that if youre paying say 25 on your mortgage and you pay it off you essentially just earned that rate on the money you used to retire the.

Web Are there any points I need to consider about paying their mortgage off from a legal standpoint. Your payment history and amount owed have already been factored into your credit score. Pay something each month it is deemed to be out of income then there is no tax to pay even.

File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way. Web Yes whilst paying off someones mortgage is an incredibly generous offer its possible there could be some potential inheritance tax IHT implications for the recipient.

Should You Pay Off Your Mortgage Or Invest The Cash

Should You Consider Paying Off The Mortgage Early Or Investing Instead Planeasy

Lifetime Mortgage Calculator Legal General

Do You Still Pay Property Tax After House Is Paid Off Omega Lending

4 Ways To Pay Off Someone Else S Mortgage Wikihow

Housing Bubble Getting Ready To Pop Pending Sales Plunge In June Inventory Jumps Price Reductions Spike Amid Holy Moly Mortgage Rates Wolf Street

Reverse Mortgage Manufactured Home Requirements For 2022

4 Ways To Pay Off Someone Else S Mortgage Wikihow

![]()

Paying Off Someone Else S Mortgage Moneysavingexpert Forum

How To Use Gift Money For A Down Payment Moneytips

Silicon Valley Residents Say State Death Tax Needs To Die

How To Easily And Effectively Give Money To Family Members Brett Stumm

Can I Pay Someone Else S Loan Off For Them By Sending Money Directly Into Their Mortgage If So Would They Have To Pay Tax On It As Income Or Would It Be

Mortgage Interest Tax Deduction Guide Nextadvisor With Time

Ask An Ex Banker Mortgages Part Ii Should I Pay My Mortgage Early Bankers Anonymous

Your Time Magazine Brisbane Sept 2022 By My Weekly Preview Issuu

Can You Pay Off Someone Else S Mortgage Moneytips